In today’s integrated economy, foreign loans play an important role in helping Vietnamese businesses access significant and favorable funding from international financial organizations. However, registering and reporting foreign loans is a mandatory legal requirement to ensure transparency and regulatory compliance. This article provides a detailed guide on the procedures, necessary documentation, and important legal considerations to effectively manage foreign loans

What is a Foreign Loan?

Definition and Role of Foreign Loans

A foreign loan is a source of capital that businesses in Vietnam borrow from foreign financial institutions, investment funds, or individuals. The main role of this loan is to provide significant financial resources for businesses to invest in important projects such as expanding production, purchasing modern equipment, or developing infrastructure. Additionally, foreign loans often come with favorable interest rates and flexible loan terms, which help businesses improve their competitiveness. Full compliance with foreign loan regulations also contributes to enhancing the business’s reputation in the international market.

Common Types of Foreign Loans

There are three common types of foreign loans that businesses often choose:

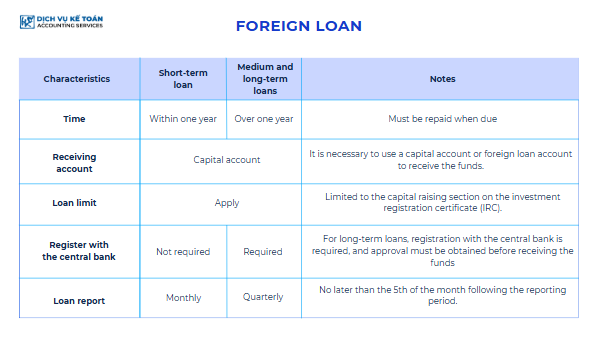

- Short-term loans: These loans have a term of less than 1 year and are mainly used to supplement working capital or pay short-term expenses.

- Medium-term loans: These loans have a term of 1 to 3 years and are typically used for projects with a quick payback period, such as upgrading equipment or expanding small-scale production.

- Long-term loans: These loans have a term of more than 3 years and are used for large-scale projects, such as building factories, investing in infrastructure, or conducting research and development for new products.

Rights and Responsibilities of Businesses When Borrowing Foreign Loans

Businesses that borrow foreign loans have the right to access large amounts of capital, improve cash flow, and expand their operations. However, they must also comply with responsibilities such as registering the loan, submitting periodic reports on the use of funds, and ensuring the loan is used for its intended purpose. Failure to comply with these responsibilities may result in penalties or lost opportunities for future international cooperation.

Legal Regulations Regarding Foreign Loans

According to Circular 12/2022/TT-NHNN, foreign loans must be registered and reported periodically to the State Bank of Vietnam. This regulation ensures financial transparency and controls the use of funds. Businesses that do not comply may face administrative fines, suspension of operations, or loss of credibility with international partners.

2. Guide to Registering a Foreign Loan

Documents Required to Register a Foreign Loan

To register a foreign loan, businesses need to prepare the following important documents:

- Business Registration Certificate: Notarized copy.

- Loan Agreement: Both English and Vietnamese versions, properly notarized.

- Capital Account Confirmation: From the commercial bank where the business has its account.

- Foreign Loan Registration Application: According to the prescribed format of the State Bank of Vietnam.

Proper preparation of complete and accurate documents not only helps businesses save time in processing but also ensures compliance with legal regulations.

Process for Submitting Documents to the State Bank of Vietnam

After completing the necessary documents, businesses need to submit them directly or send them by mail to the local branch of the State Bank of Vietnam. The process includes:

- Submit the Documents: Send the documents to the competent authority.

- Review and Supplement: The State Bank of Vietnam will review the validity of the documents and request additional documents if necessary.

- Approval: Valid documents will be approved within 30-45 working days.

This process ensures that the foreign loan is legally registered and meets the capital usage conditions.

Mandatory Requirements for Registering a Foreign Loan

Businesses must ensure the following conditions when registering a foreign loan:

- Loan Agreement in Compliance with the Law: The content of the agreement must comply with Vietnam’s financial and commercial regulations.

- Legal Capital Account: All transactions related to the loan must go through a capital account registered with the State Bank of Vietnam.

- Periodic Reporting: Submit complete and timely reports on the use of funds.

Processing Time and Fees

The processing time typically takes 30 to 45 working days, depending on the completeness and accuracy of the documents. The fees include notarization, translation, and bank transaction fees.

3. How to Report a Foreign Loan?

Legal Requirements for Reporting Foreign Loans

According to current regulations, businesses must report the usage of foreign loans on a monthly basis, no later than the 5th of the following month. Reports can be submitted online through the State Bank of Vietnam’s management system or in writing if there is a technical issue with the system.

Documents Required for Periodic Reporting

The periodic reporting documents include:

- Loan Implementation Report (as per the prescribed format).

- Capital Account Balance Confirmation from the commercial bank.

- Documents proving the proper use of funds.

Businesses should prepare and carefully check these documents to ensure the report is accurate and to avoid violating regulations.

Instructions for Submitting Reports Online to the State Bank of Vietnam

Businesses need to register for an account on the online system at www.qlnh-sbv.cic.org.vn. After logging in, enter the required information and upload the related documents. This process saves time and ensures transparency in reporting.

Penalties for Failing to Report or Providing Incorrect Reports

Failure to submit a report or submitting incorrect reports may result in a fine ranging from 10 million to 20 million VND. In cases of serious violations or repeated offenses, the fine can increase to up to 60 million VND, which can affect the business’s reputation and operations.

4. Important Considerations When Managing Foreign Loans

Regulations on Proper Use of Foreign Loans

Businesses are required to use foreign loans for the purposes registered with the State Bank of Vietnam. Common purposes include infrastructure investment, equipment purchase, or working capital supplementation. Using the loan for unauthorized activities, such as investing in restricted areas or personal expenses, will result in severe penalties. According to Circular 12/2022/TT-NHNN, using funds for improper purposes can result in fines ranging from 300 million to 400 million VND, along with other legal penalties.

Handling Changes in Loan Terms

If there are any changes in the purpose, term, or lender, the business must notify and register the change with the State Bank of Vietnam within 30 days of the change. The adjustment documents include a registration form, the amended loan agreement, and relevant supplementary documents. Failure to comply with this procedure may result in administrative penalties and affect the ability to borrow in the future.

Procedure for Loan Extension or Conversion

If the loan is approaching its maturity but has not been repaid, the business must apply for an extension with the State Bank of Vietnam. If the business wants to convert a short-term loan into a long-term loan, it must submit the conversion agreement and related documents. The extension and conversion process typically takes 15 to 30 working days, depending on the complexity of the documents.

Risks and How to Avoid Legal Violations

Businesses managing foreign loans need to be aware of legal risks, including failing to report on time, using the funds for improper purposes, or not complying with regulations regarding loan information changes. To avoid violations, businesses should regularly update the latest legal regulations, develop a robust financial management plan, and fulfill all legal obligations related to the loan.

5. Frequently Asked Questions About Foreign Loans

How long does it take to register a foreign loan?

The processing time for registering a foreign loan typically ranges from 30 to 45 working days. This depends on the completeness and accuracy of the documents submitted by the business. To ensure timely processing, businesses should prepare documents carefully and follow the guidelines from the State Bank of Vietnam.

Do short-term loans need to be reported?

According to current regulations, all foreign loans, including short-term loans, must be reported periodically on a monthly basis. This report helps regulatory authorities monitor the use of funds and ensure the business complies with legal requirements.

Legal regulations when loans are not repaid on time

Businesses that fail to repay loans on time will be subject to administrative penalties or late payment interest according to the loan agreement. In some cases, the State Bank of Vietnam may implement stricter controls on loans from businesses in violation, which can affect the business’s reputation in the international financial market.

How to adjust loan information?

When there are changes to loan information, businesses must submit an adjustment request and related documents to the State Bank of Vietnam. The adjustment process must be completed within 30 days from the date of the change. Failure to comply with this regulation may result in legal penalties or affect future borrowing capabilities.

A foreign loan is an effective financial tool that helps businesses expand their scale and enhance international cooperation. However, to ensure legal compliance and optimize benefits, businesses must fully understand the processes for registering, reporting, and managing foreign loans. If you need assistance, please contact us for detailed advice.

If you have any questions, please contact our Hotline at (028) 3820 1213 or email us at info@wacontre.com for prompt consultation and support. With an experienced team, Service thanhlap.wacontre.com is always ready to serve customers in the most enthusiastic and efficient manner. (For Japanese customers, please contact Hotline: (050) 5534 5505).